Our history

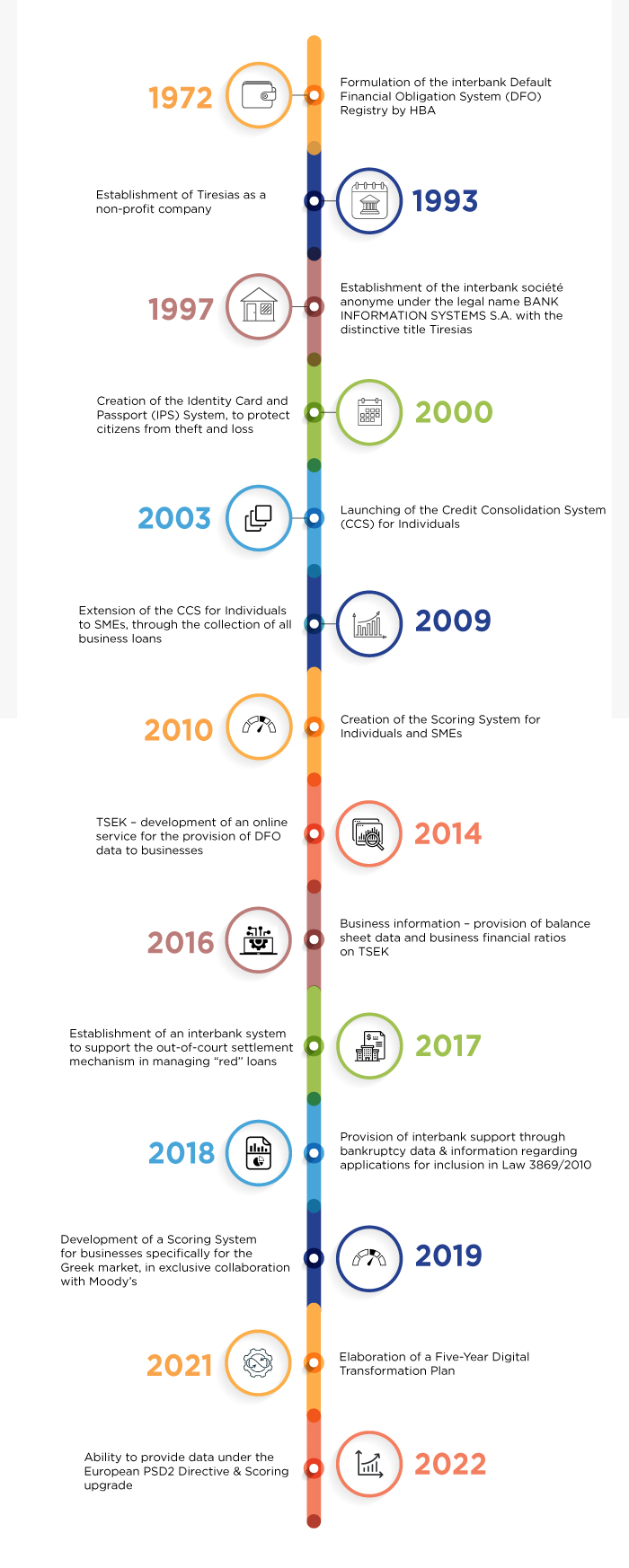

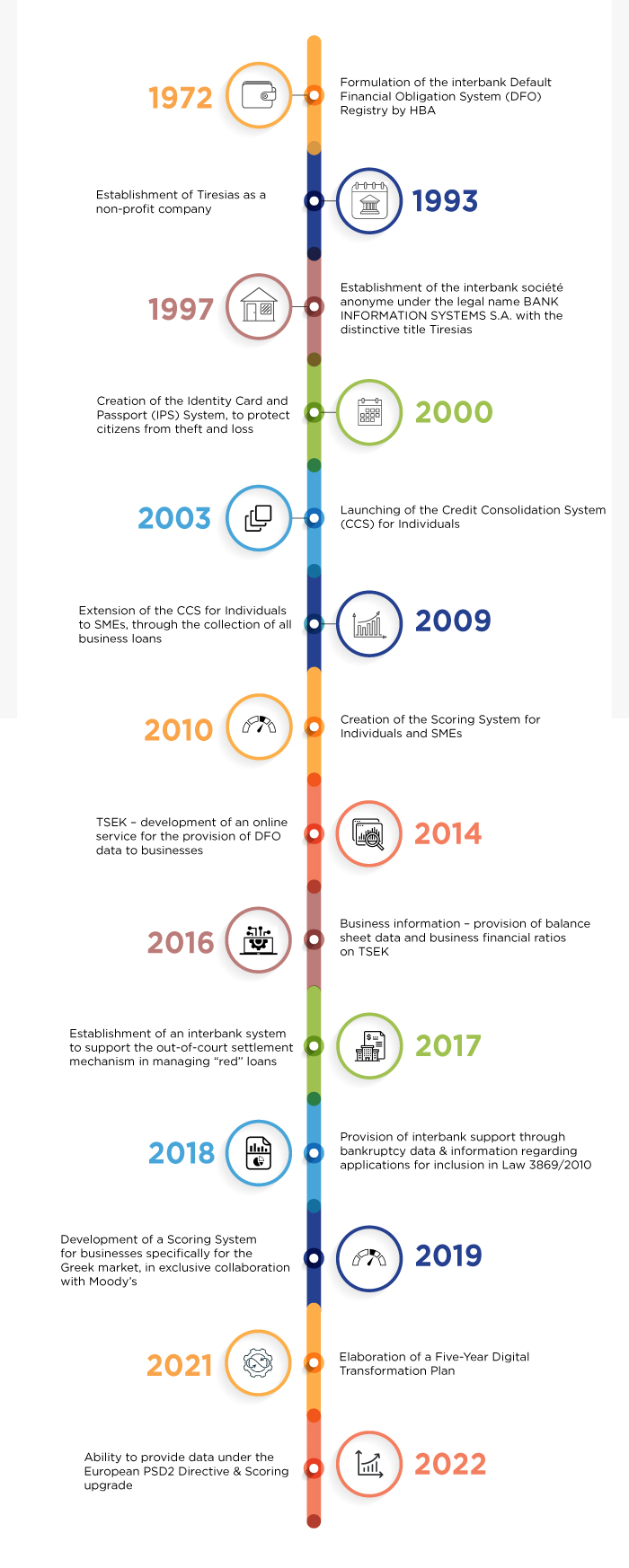

Our story begins in 1972 when, as a service of the Hellenic Bank Association, we were assigned the Register of the Default Financial Obligation System (DFO).

This demanding work led to the establishment of Tiresias in 1993, as a non-profit company tasked with developing an information management system for the DFO registry.

In 1997, Tiresias S.A. was founded by banks operating in Greece, with the mandate to collect, process, manage and provide financial behaviour data to credit institutions.

A milestone year was 2003, when we were interconnected with the Banks and our database started to expand owing to the Register of the Credit Consolidation System (CCS) for natural entities, which provides an integrated and accurate picture of their creditworthiness.

In 2010, in line with the requirements and demands of the financial market, we created a creditworthiness scoring system, which assesses the probability of a future default, based on a statistical evaluation of past transactional behaviour.

In 2014, Tiresias’ outreach to the business market was further enhanced through TSEK, an online service that provides businesses access to DFO data from our database, and thus valuable insight into the solvency of their commercial partnerships.

Over the years, we have demonstrated our know-how by supporting major public sector projects assigned to us by Banks, such as the out-of-court debt settlement mechanism, by assuming the communication between Banks and the Public sector and ensuring the functionality of the relevant mechanism.

Since 2021, we have been closely following technological developments and the needs created by the new era. More specifically, we are implementing a five-year digital transformation plan, while applying every safeguard for the security and protection of the data kept on our database, pertaining to both natural and legal entities.

Unquestionably, the high quality of the information provided by Tiresias, which is characterized by its accuracy, completeness and continuous updating of data, along with its full institutional compliance, whose core value is the security and protection of personal data, have had a decisive impact on the company’s long, successful course.

Our work continues, as we prioritize in catering for the evolving needs of the financial sector and healthy entrepreneurship. Our key criteria are to support a healthy transaction system, credit as an institution, and the growth of Greek economy in general.